10 Jun What the Election Result Means for Educators and EdventureCo

Introduction

As the dust settles on the election campaign which saw the return of the Coalition Government, it is an opportune time to consider what the result means for the tertiary education sector, and the possible implications for EdventureCo.

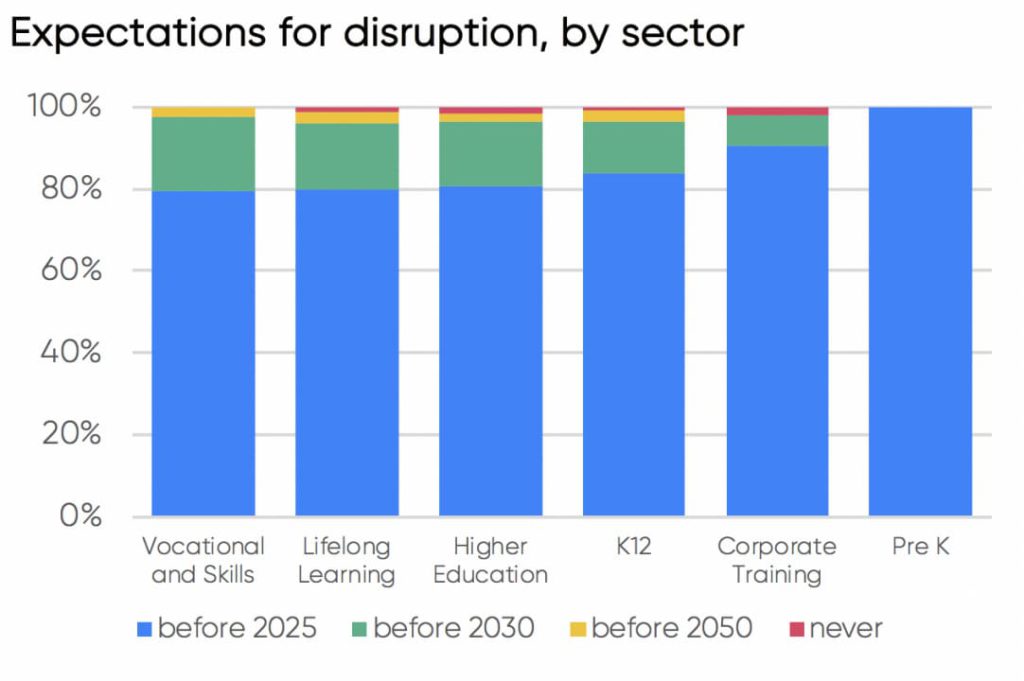

Education experts expect major disruption to education to occur by 2025 according to leading education market intelligence firm, HolonIQ. Will the policies of the returning Government align with these predictions of disruption to the sector? And will these policies support growth and innovation within the Australian education sector?

Whilst EdventureCo does not hold any political affiliations with any particular party, any incoming Government, be they new or returning, can have an impact on education businesses. Their strategic priorities, approaches to migration, education and labour market policy commitments as well as approaches to state and commonwealth funding can naturally create head or tailwinds depending on the level of exposure to those sectors for each education business.

Considerations

Here are the top 5 key considerations and expected level of impact for EdventureCo.

1. Incoming Government Intentions

Coming into the May 2019 election the Government promised a number of new measures to support their tertiary education direction and the pre-election budget provided further detail on their intentions. The key aspects of their campaign included:

- 80,000 extra apprenticeship places with funding directed to employer and apprentice subsidies (the initiative will unfortunately add only a limited number of extra training places to the VET system, most will come from displacing activity in other Government-funded VET),

- a modest expansion of the regional apprenticeship wage subsidy scheme,

- expansion of the PaTH internship scheme and the Transition to Work service for young unemployed people (both of which have a modest training component),

- funding for individual Universities for specific initiatives, and

- an expansion of the regional study centres (to encourage rural students to stay at home and study at University or TAFE rather than moving to the cities).

2. VET Provider Impacts

Given the modesty of the Government’s policies for VET and higher education there are unlikely to be any major changes to the system. We expect the current policy, funding and regulatory settings to remain relatively stable.

That means the VET Student Loan scheme and international education are unlikely to be subject to any significant changes. The only exception is relatively modest changes to international student visa arrangements to encourage more students to study in regional centres.

The lack of any meaningful new Government funding for VET is going to make organic growth in funded programs difficult for those private providers who rely heavily on funding and will continue to put strain on some TAFEs. Both TAFE NSW and TAFE QLD are dealing with significant declining revenues and as a result their respective State Governments may redirect some of their VET funding from private providers to TAFE to help meet the funding gap.

Growth in the private VET sector is therefore likely to come through:

- growing fee-for-service revenue streams including:

- B2B – where the education business is paid directly by companies for conducting the training of their staff

- international onshore – international students studying programs in Australia

- transnational – Australian educators delivering to offshore students often through local partners, and

- domestic – domestic students paying fees directly, not accessing any state or federal Government subsidies or loan schemes, or

- mergers and acquisitions to assist them to achieve greater scale in the domestic sector.

EdventureCo does not currently have any VET Student Loans exposure so there will be no impact here. EdventureCo may be able to benefit from additional apprenticeship places or employer incentives in Trades. Less than 10% of EdventureCo’s current revenue comes from state or federal funding sources so EdventureCo is largely protected from changes in state or federal funding allocations.

The expectations of growth in the sector being delivered through fee-for-service avenues and through mergers and acquisitions aligns with EdventureCo’s strategic approach and will provide opportunity for continued growth of the portfolio.

With respect to the modest changes in international education, EdventureCo does have international student revenues but has no regional campuses currently. Therefore, EdventureCo is unlikely to participate in any incentives directed towards international students studying in regional areas.

3. University Impacts

The Government’s approach to university funding (connecting growth funding to specific performance measures) will likely see most universities continue to strongly pursue international student enrolments as a key revenue source. This is likely to be good news for pathway providers such as Navitas, Study Group and others.

The continued restrictions on domestic university funding will mean continued opportunities for niche private higher education providers (e.g. RedHill) to grow domestic enrolments, albeit subject to their ability to present a credible case for an increase in their FEE-HELP funding.

4. Training Packages and Course Development

The Australian VET sector is finding the inadequate levels of funding a challenge. It is also hampered by the design of National Training Packages (which specify what can be taught by VET providers). Introduced in the 1990s they are quite prescriptive documents, with lengthy approval processes and complex governance arrangements. That means it can take longer to introduce new courses into the VET system in Australia than it does in other countries, reducing innovation and flexibility in course design to meet the needs of industry. For a useful and deeper insight into comparisons of key countries in relation to curriculum design and links between VET and their industries in general, by Kevin Chin (Managing Director, Arowana International), click here.

The Government commissioned a review late last year, the Joyce Review, which recognised the problem and made some recommendations for change. In the April Budget the Government allocated funding to two pilot schemes to trial new ways of developing national qualifications and short courses in VET. The pilots are likely to take time and there is currently little appetite for these reforms among VET stakeholders more broadly, particularly business peak bodies and Unions.

As a result of these challenging constraints it’s likely that those parts of the Australian VET system which are focussed on low cost, poor quality short courses or corporate training are susceptible to disruption, as these kinds of courses ($15-$500 courses usually) can easily be undertaken online.

Whilst National Training Packages do constrain flexibility in EdventureCo accredited course development, EdventureCo brands have recognised this constraint and actively seek to address it by developing service delivery models, additional products and/or services to ensure that the program of learning a student can undertake goes beyond traditional curriculum and qualifications, and offers the opportunity to develop the skills, characteristics and even attitudes that industry is looking for. Examples of how EdventureCo brands are tackling this will be shared in future blogs.

5. Short Courses

Whilst the incoming government have no specific policies that impact this segment of the education sector it is worthy of attention here given it is undergoing significant change that will impact how training in the workplace will be done in the future.

Respondents from Holon IQs executive panel surveys expect the low-cost commoditised corporate training sector to experience significant disruption at a faster pace than other adult-learning segments, most likely due to lighter regulatory constraints, talent shortages and urgent upskilling requirements.

HolonIQ, 2019, Global Education Expectations. Q1 2019 Executive Panel (https://www.holoniq.com/notes/global-expectations-snapshot-april-2019-holoniq-global-executive-panel-results)

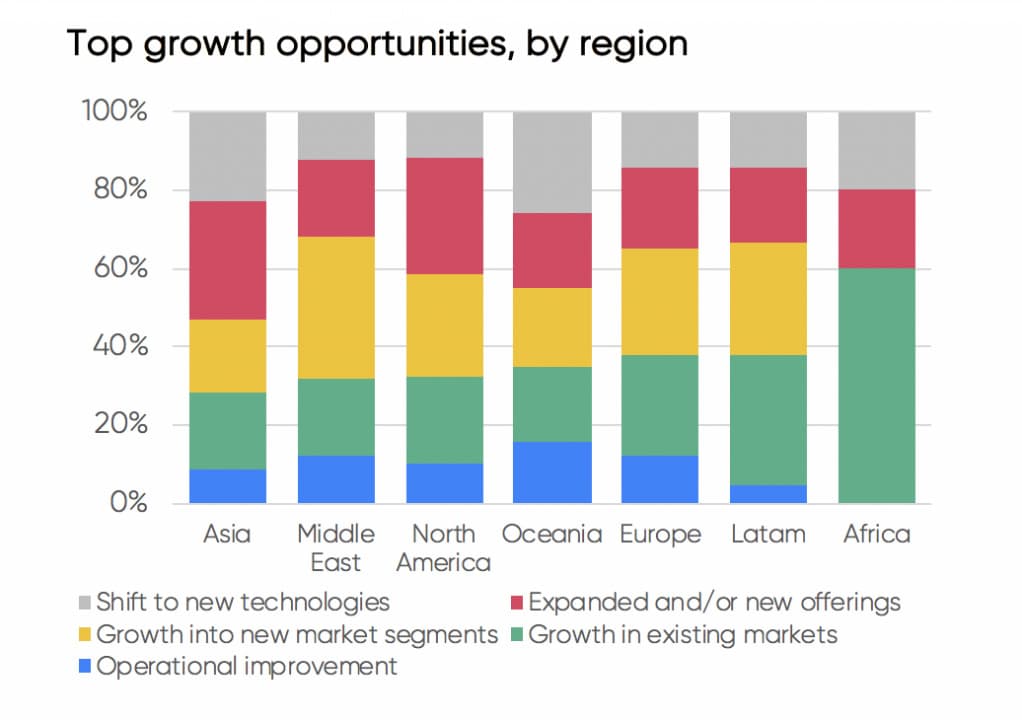

This is particularly true in Australia (Oceania) and Asia as seen in the below graph.

HolonIQ, 2019, Global Education Expectations. Q1 2019 Executive Panel (https://www.holoniq.com/notes/global-expectations-snapshot-april-2019-holoniq-global-executive-panel-results)

However, the premium end of instructor-led training particularly for enterprise employees is not expected to dissipate. In fact we are seeing it increase as high cost employees often find it very challenging to commit the necessary time for online training while still doing their day job. Nor are they interested in studying from home in their own personal time when that training is a work requirement and the training is paid for by the employer. This may be different however when the learning chunks required are less than one or two hours at a time. This trend creates opportunity for EdventureCo.

Whilst increasing numbers of enterprises are seeking to provide their staff with short-course programs offered by online providers such as Go1 or Udemy, there is a strong and growing market for premium, instructor-led training in areas where high cost employees need high quality training and need to minimise time out of the office to undertake that training, and maximise the impact of that learning so it can translate into outcomes immediately.

EdventureCo’s ICT brand DDLS is a fantastic example of a training business that meets the need of companies seeking to upskill their staff. DDLS delivers a premium short-course (often 1 to 5 day bootcamp-style) instructor-led training offering for ICT professionals, nationally. Such is the appetite for this rapid and effective industry-certified training, that DDLS is expanding into Asia with its first site in the Philippines due to launch soon.

Summary

With plans to:

- further extend our impact in non-accredited industry-certified training for employers

- grow our domestic fee-for-service offerings

- continue to expand our onshore international programs and geographies

- and take advantage of appropriate acquisitive opportunities aligned with our strategic priorities,

EdventureCo and its brands are well positioned to succeed in the near to mid-term regulatory environment.

We don’t expect in the short-term to participate in any upside from regional incentives for international students as we don’t have a current offering in this space but may benefit from the limited additional apprenticeship places.

We are passionate about the innovation of programs, products and services that go beyond the qualification to ensure students are ready for success tomorrow in the real world, particularly in ICT and Trades given our current offerings there. We welcome the incoming Government and are keen to work with key ministers, their teams and regulators on policies that enable further innovation in the sector.

About EdventureCo

Preparing the people and businesses of today, for success tomorrow.

EdventureCo has adopted an unconventional but effective approach to portfolio growth in the Tertiary Education sector. We don’t centralise the heart, soul or autonomy of the brands we buy or build, instead we pride ourselves on working alongside brand leaders and their teams in a partnership model to empower them and help them fulfil the potential of that brand.

The EdventureCo team operates as a strategic services group who deeply align themselves with the unique needs of each brand and its sector of specialisation. We provide tangible services and introduce unique philosophies that challenge traditional thinking, encourage fresh perspectives and develop a purposeful and inspiring future for all stakeholders impacted by that brand.

Using our unique ‘Pyramid Method’ we inspire a culture of engagement, empowerment and inspiration. Our model develops clarity, alignment and generates the necessary connective tissue between vision, strategy, culture and execution. It ensures continuous adaptation to the internal and external environment, cultivates an unwavering belief in the team’s ability to succeed and leads to long-term sustainable value creation. Importantly, we have a great time along the way.